Reclaim Your Youth and Vitality with TRT in Rockleigh, NJ

It can be hard to hear for some, but getting older is just part of life. For many men, hitting a certain age signifies the beginning of a new chapter - where bucket list items are crossed off, and goals are accomplished. For others, however, aging is a scary prospect, filled with nagging injuries, embarrassing weight gain, and inability to perform intimately. Few things feel worse than realizing that you simply can't perform as you used to, whether on the basketball court or in the bedroom.

The reality is, as men get older and approach middle age, their testosterone levels drop. When a male's testosterone levels get lower, it can cause a slew of unwanted symptoms like:

If you have noticed any of the above symptoms and feel like you're just dragging yourself through life, don't lose hope. Many men around the country are experiencing the same feelings as you. Thankfully, you don't have to settle for the side effects of low testosterone. There are proven, easy steps that you can take to reverse the negative signs of aging. If you're ready to reclaim your youth and feel like you did in your 20s and 30s, testosterone replacement therapy (TRT) may be the perfect solution.

TRT bridges the gap between your old life and the happier, more vibrant version of you. That's where Juventee comes in - to facilitate your transition to a more youthful, fulfilling life and a brighter future. After all, aren't YOU supposed to be in charge of your wellness and health? With the Juventee team by your side, you'll have the tools to do so - backed by a personalized plan crafted by experts with more than 20 years of experience.

The Juventee Difference

At Juventee, we propose a preventive and proactive medical approach to preserve optimal body function, with the best hormonal functioning to prolong vitality and youthfulness. Our specialty is Age Management, which is based on the belief that balance is the key to wellness. We employ the most innovative science, offering treatments like TRT in Rockleigh, NJ, and other clinical products with proven efficacy.

Living a younger, healthier, and longer life is a frequent commitment for Juventee's team of specialists. We are experts at designing customized programs that work synergistically with your body and brain. We love incorporating smart nutrition, hormonal balance, exercise, stress management, cognitive health, and lifestyle changes into our treatment programs. We also implement sciences such as testosterone replacement therapy to achieve verifiable, legitimate results.

Our doctors take differing approaches to care but share the single goal of prolonging your youth and vitality. With that goal in mind, Juventee was born from the hands of its partners, who want you to feel full strength, energy, joy, confidence, and wellbeing.

testosterone levels. Unfortunately, when a man loses too much testosterone, it results in a condition called hypogonadism. Also called "Low T," testosterone loss due to hypogonadism must be replenished, or the male suffers from difficult, even debilitating symptoms.

We Work With

What is Testosterone?

What pops up in your head when you think about testosterone? Many people associate testosterone with being overly aggressive, macho, and violent. However, the truth is that testosterone is a critical hormone for men and affects the male lifespan from puberty through old age. As a sex hormone, male testosterone is produced through the testicles. It becomes most prevalent during puberty.

Testosterone production is controlled by the pituitary gland at the base of a man's brain. This gland sends signals to the testes, which in turn produce testosterone. A feedback loop helps regulate the amount of testosterone in the blood. When levels are too high, the brain orders the pituitary gland to restrict production.

Did You Know?

Cholesterol synthesizes the testosterone in your body. However, having high cholesterol doesn't mean you have high testosterone levels, too. T levels are too carefully controlled by your pituitary gland for cholesterol to raise testosterone levels.

During puberty, testosterone helps males develop:

- Body Hair

- Facial Hair

- Muscle Strength

- Increased Libido

- Deeper Voice

- Muscle Density

- Sperm

What is TRT in Rockleigh, NJ?

Testosterone replacement is exactly what its name implies. It's a therapy for men that replaces diminished testosterone levels, which helps balance your hormones and ultimately improves your life. Also called androgen replacement therapy, TRT alleviates many of the side effects that men suffer from as a result of low testosterone.

Testosterone was originally synthesized in a lab in 1935. Its popularity has grown since, and today, it is among the most promising doctor-prescribed treatments for men in the United States.

So, how does testosterone replacement therapy work? TRT essentially gives you the testosterone needed to be healthy and have a properly functioning body. As the primary androgen for males, testosterone has a role in the natural processes your body needs for overall health. This extra hormonal intake positively affects patients and their general health, preventing diseases such as osteoporosis, cardiac diseases, and more.

Though there is an abundance of testosterone in your system throughout puberty and into your 20s, it gradually depletes with age. Sometimes, serious injuries and long-term conditions like diabetes affect testosterone levels. Unfortunately, when a man loses too much testosterone, it results in a condition called hypogonadism. Also called "Low T," testosterone loss due to hypogonadism must be replenished, or the male suffers from difficult, even debilitating symptoms.

Common Signs of Low Testosterone

Though some symptoms of low T are abundantly evident, not all men can immediately tell they may need TRT. If you're unsure, ask yourself these questions:

- Are you usually a productive powerhouse but now feel like you lack drive and motivation?

- Have you had a normal sex life in the past but now find that you're losing the ability to be intimate?

- Are you usually calm and collected, but your partner is complaining about your irritability?

If you answered yes to any of those questions, it could be time to contact Juventee about a personalized TRT plan. Still unsure if you're experiencing symptoms of low T? We have compiled a more extensive list of signs below:

Decreased Energy

Low energy used to be considered a normal part of aging. Today, most doctors know better. Modern advances in medicine show that lack of energy and low T often go hand-in-hand.

If it's a huge struggle to keep up with your kids on the soccer field, or you just don't have the energy to be active, you may have low testosterone. Getting tired is normal, but if it's an ongoing problem affecting you and your family, it's time to consult a doctor.

Whether you're having a tough time getting through your day or can't finish normal activities, TRT in Rockleigh, NJ could be the solution.

Lowered Libido

You would think that lowered libido would be easy to pick up on, but when it happens gradually, it can be more difficult to diagnose. With that said, many men use TRT because they've lost that "spark" in the bedroom. It's not easy for a man to hear that they're not pleasing their partner because intimacy is an important part of a relationship.

The good news? Having a low libido doesn't have to be permanent. TRT treatments can help revert hormone levels to their normal range, making for a more enjoyable sex life.

Hair Loss

If you're like millions of other men, hair loss is an unfortunate reality you don't want to think about. Closely related to hormone imbalances and testosterone decline, hair loss is about as distressing as it gets. This common symptom is often related to DHT - a derivative of testosterone that can cause hair follicles to die.

Thankfully, a carefully monitored TRT regimen can help restore hair, especially when combined with methods like plasma-rich therapy. While it's true that you can't change your genes, you can change the effects of low testosterone in your body, so hair loss isn't your only reality.

Inability to Achieve and Maintain Erections

Weak erections - it's an uncomfortable subject for men to talk about. It's even worse to experience the symptom in the heat of the moment. Despite being very common, men shame themselves when they can't achieve an erection. And while there are many reasons for this malady, low testosterone is often a contributing factor.

Fortunately, you don't have to live with weak erections forever when you balance your hormones with a personalized TRT treatment plan from Juventee.

Depression

You're feeling down about everything and can't figure out why you feel crummy about life. You're successful at work but feel unaccomplished. If you're experiencing symptoms like these, you may be depressed - and it could be stemming from low testosterone.

Studies show that men with depression and high cortisol levels also commonly have low testosterone. Because higher cortisol levels can lead to low T, the chances of severe depression increase.

Depression is a very real disorder and should always be diagnosed and treated by your doctor. One treatment option, when used in conjunction with therapy, is TRT. When TRT is used to replenish hormone levels, men enjoy a lighter, more optimistic mood. That's great news for depressed men who have had little-to-no success with powerful anti-depression meds.

Lack of Sleep

Experts have found that men who lose a week's worth of sleep may experience a drop in testosterone by as much as 15%. These findings are alarming and may suggest that sleep loss lowers T levels and affects wellbeing.

If you find yourself exhausted at the end of the day but toss and turn all night long, it could be time to have your testosterone levels checked. TRT may restore your testosterone levels which can help you sleep better with proper exercise and diet.

Loss of Strength and Muscle Mass

Are you struggling to lift weights in the gym or find that you can't pick up items that used to be easy to lift? Studies show that inactive men can lose .5% of muscle strength each year after the age of 25. When you hit 60, muscle loss doubles every ten years. While muscle loss is common with age, it can also be linked to low T.

Testosterone is a crucial piece needed for building and retaining muscle mass. That's why many doctors are prescribing TRT for males experiencing sharp declines in strength and muscle mass. Whether your workouts are losing steam or you're having problems lifting items that aren't very heavy, don't blame it all on age. You could be suffering from hypogonadism.

Weight Gain

Nobody likes to gain weight, even though our society is more accepting of overweight people than ever before. Despite diets and carb cutting, many men aren't able to get rid of excess belly and body fat, increasing the chances of heart disease and cancer.

Sometimes, male weight gain isn't caused by sweets and carbs but by hormone imbalances that slow the metabolism. This phase of life is called andropause and occurs when testosterone levels are low. Combining a low metabolism with other symptoms like high cortisol levels can be a recipe for a double-chinned disaster. Fortunately, TRT treatments and physician-led weight loss programs can correct hormone imbalances and lead to healthy weight loss for men.

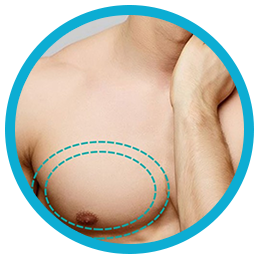

Gynecomastia

The enlargement of male breast tissue, also called "man boobs," is a fairly common condition that many men have. Though it is closely associated with diet and other life choices, increased fatty tissue is often caused by hormonal imbalances.

If you're approaching middle age and you're embarrassed by having large breasts, don't lose hope. TRT is a safe, effective way to eliminate the underlying cause of gynecomastia without invasive surgery. With a custom HRT and fitness program, you can bring your testosterone and estrogen levels back to normal before you know it.

Be the Best Version of Yourself with TRT in Rockleigh, NJ

The human body is amazing in so many ways. Still, we have to optimize it every now and then using science, medicine, and hard work. After 40, you may notice that your body is changing, but symptoms like low libido and lack of motivation don't have to be permanent. Juventee has the team, tools, and experience to help recapture your youth and feel better than ever before.

If you're getting older and you're worried about low testosterone, give our office a call today. It would be our pleasure to care for you using the highest quality products, backed by research and applied by professionals with your best interests in mind.

Whether you need a boost to help you get through your busy work week or a natural solution to an embarrassing problem like ED, we're here for you. Our doctors will explain your treatment options in-depth and take as much time as you need to feel comfortable and confident about TRT. Remember, when you treat your body with love and care, it will reciprocate generously. Let our team teach you the techniques to prolong your sense of youth and provide you with the treatment to solidify your wellbeing as you age with grace. Contact Juventee today. By tomorrow, you'll be one step closer to meeting the best version of yourself.

Latest News in Rockleigh, NJ

Ramapo College announces 2024 Distinguished Citizens Awards honorees

ByLinda Lindner (Mahwah) -https://www.roi-nj.com/2024/02/12/education/ramapo-college-announces-2024-distinguished-citizens-awards-honorees/

The Ramapo College Foundation will honor four individuals for their professional achievement, commitment and community service at its Annual Distinguished Citizens Gala.State Sen. Paul Sarlo, Brian & Diane Flynn, Class of 1985, and Nicole Cicalo DeCaro will be honored at the gala April 5 at the Rockleigh Country Club in Rockleigh.Sen. Paul Sarlo (D-Wood-Ridge) is the deputy majority leader of the New Jersey Senate. He has served as chairperson ...

The Ramapo College Foundation will honor four individuals for their professional achievement, commitment and community service at its Annual Distinguished Citizens Gala.

State Sen. Paul Sarlo, Brian & Diane Flynn, Class of 1985, and Nicole Cicalo DeCaro will be honored at the gala April 5 at the Rockleigh Country Club in Rockleigh.

Sen. Paul Sarlo (D-Wood-Ridge) is the deputy majority leader of the New Jersey Senate. He has served as chairperson of the Budget and Appropriations Committee since 2010, making him the committee’s longest serving chairperson in state history. He is a member of the Judiciary Committee and chairperson of the Joint Budget Oversight Committee, and former chairperson of the Judiciary Committee and the Labor Committee. Sarlo has been the prime sponsor of more than 300 bills that have been signed into law and has played a leading role on legislation to promote job creation and economic development. He has been the prime sponsor of bipartisan legislation that reformed the state’s school funding formula, lowered income taxes for the middle class, working poor and senior citizens, strengthened the fiscal health of the state pension fund and provided dedicated funding for the Transportation Trust Fund to finance vital infrastructure projects throughout the state. He has also sponsored bills that reformed New Jersey’s workers’ compensation system, criminalized the illegal trafficking and distribution of prescription drugs, required schools to adopt bullying prevention policies and upgraded penalties for identity theft.

Brian Flynn is a partner at PKF O’Connor Davies LLP, the leading North American firm in the PKF International network of independent accounting and advisory firms. Flynn is a member of the Executive Committee and managing partner for the firm’s New Jersey market. Flynn has more than 30 years of audit experience with closely-held corporations, educational institutions and not-for-profit organizations. He earned a bachelor’s degree in accounting from Monmouth University. He serves on the board of Lakeland Bank and is an active participant in numerous community and professional groups. Brian often serves as a conference leader and speaker at industry events and sits on the boards of several local not-for-profit organizations.

Diane Flynn is a Ramapo College alumna, having earned a bachelor’s degree in information systems in 1985. She has worked in human resources/employee benefits and has been an editor at Paulist Press. The Flynns have been longtime donors to Ramapo College, having made a major gift to the capital campaign to build the Berrie Center for Performing and Visual Arts. The couple also has supported the Distinguished Citizens Gala and Golf Outing. O’Connor Davies performs the annual audit of the Ramapo College Foundation. Over the years, Brian Flynn has been instrumental in securing significant corporate support from PKF O’Connor Davies for Ramapo College events and projects. The Flynns live in Wyckoff.

DeCaro is head coach of the Bergen Barracudas swim team, a parent-run nonprofit organization founded in 1980 that practices on the Ramapo College campus and competes at venues across northern New Jersey. She has over 22 years of coaching experience. DeCaro is a lifetime member of the American Swimming Coaches Association and is ASCA Level 3 certified. She holds a master’s in childhood special education from Fordham University and two master’s degrees from Ohio University: a Master of Science in recreation and sports management; and an MBA. DeCaro serves on the Friends of Ramapo board as the nominating chair; she has also served as chair and vice chair of the board. With DeCaro’s assistance, the Bergen Barracudas have supported the Friends of Ramapo, Summer Concerts, Annual Fund and the Distinguished Citizens Gala. DeCaro’s husband, Lawrence, is a construction project manager.

Best Fall Hikes In New Jersey

WorldAtlashttps://www.worldatlas.com/nature/best-fall-hikes-in-new-jersey.html

There is no time more beautiful for hiking than autumn. The leaves changing their hue to bright orange, red, and yellow, makes hiking in the forest an unforgettable experience. When it comes to fall hiking, New Jersey is one of the best places to go. From serene shores to Pine Barrens and mountain-like ridges, the state has a surprisingly diverse hiking scene. The Mount Tammany loop is a popular hike and is part of the Appalachians, offerin...

There is no time more beautiful for hiking than autumn. The leaves changing their hue to bright orange, red, and yellow, makes hiking in the forest an unforgettable experience. When it comes to fall hiking, New Jersey is one of the best places to go. From serene shores to Pine Barrens and mountain-like ridges, the state has a surprisingly diverse hiking scene. The Mount Tammany loop is a popular hike and is part of the Appalachians, offering amazing mountain views. The Stony Lake loop is a nice easy New Jersey hike, perfect for hikers looking for a short stroll through the autumn woods. Whether you are looking for a challenging hike with surreal forest views, or an easy stroll along a river, there is a hike in New Jersey for hikers of all levels.

Mount Tammany- Red Dot And Blue Dot Loop

One of the most popular hikes in New Jersey is Mount Tammany. The hike is popular for good reason! Mount Tammany is in the Kittatinny Mountains, part of the Appalachian Mountain Range. The trail is not too much of a challenge, it is short but deceptively steep. The views are worth the hike. The trail offers a view of Mt. Minisi on Pennsylvania side of the Delaware Water Gap.

The trailhead is off of Interstate 80. There are several large parking lots in the area, but they do fill up fast on nice days. The trail starts just a short walk from the parking lot, at the Dunfield Creek natural Area Trailhead.

There are two versions of Mount Tammany trail, the Red Dot and Blue Dot trail. The Blue Dot trail is easier than the Red Dot trail. There is a small but steep section of the Red Dot trail that requires scrambling up part of the mountain. The section is easiest going uphill so many people start the trail counter-clockwise. Even though the Red Dot trail is more difficult the views up the summit of mountains covered in forest are worth it.

White Shore and Long Path Loop Trail

The White Shore and Long Path Loop Trail is near Rockleigh in New Jersey. The trail is challenging but has outstanding views. The path is rocky and winds through forest. On average, hiking the trail takes an hour and 57 minutes to complete. This trail is very popular and is typically busy on nice days.

The trail begins in the parking area at the State Line Lookout, where you will see the trail sign that reads Ski Trails. This is the trail you walk on for the loop. Walking a little farther along you will see blue blazes, this is the start of the White Shore and Long Loop Path. The first section of the trail goes north from the Palisades Interstate Park Visitor Center and Café. There is a cliff from there that the trail takes you down, where you will see a beautiful waterfall that empties into the Hudson.

Those who do not want to complete the full hike or are looking for an easier hike can return back up instead of doing the full loop. However, those who want to continue on will face a more difficult, rocky trail. The Giant Stairs is the most difficult part of the trail, but it leads you higher up where you will get better views of the forest.

High Point State Park – Monument Trail

If you are looking for a hike with higher elevation, the Monument Trail is the one to do. The Monument trail hikes a section of the Appalachian trail to the highest elevation in New Jersey. It's a 3.8 mile loop that is moderately challenging. The terrain on the trail alternates between very rocky and smooth. There is an uphill climb towards the monument, but the rest of the hike is downhill. From the monument there is an amazing view of the forest below. Bfore getting to this point, the hike is on the shores of Lake Marcia, which also offers breathtaking views of the water and forest.

On average, the trail takes an hour and 36 minutes to complete. The trail is popular year round for it's beautiful, vast views of New Jersey, Pennsylvania and New York. Since Monument Trail is in the farthest northwest corner of New Jersey, the park itself has many beautiful views aside form the hike. There is also an Atlantic cedar swamp near the trail. The trail's signs are easy to follow.

Stony Lake Loop

The Stony Lake loop is a pleasant hike in New Jersey. The trail is 2.5 miles and take an average of 22 minutes to complete. The route is easy, but is still on natural grounds; meaning there is not a paved walkway. There are lots of rocks, roots and sticks on the path. Although there is rocky terrain, there is little elevation changes. The hike starts at the Stony Lake parking lot, off of Coursen Road. The hike offers views of the peaceful waters of Stony Lake and in the autumn season, the trees around the lake change color. Past the halfway point of the loop there are also two waterfalls easily viewed from the trail.

Stony Lake is a popular tourist spot for fishing, boating and swimming in the summer. There are many species of turtles that live in the lake, along with several different kinds of fish, including catfish and bluegill.

Sunfish Pond

Sunfish Pond is a popular destination because of the stunning scenery seen on the trail. The pond is actually a glacial lake surrounded by beautiful forest. From some of New Jersey's most dense, beautiful forests, to a glacial lake 1,000 feet above the surrounding area, Sunfish Ponds is the perfect fall hike in New Jersey. The route is difficult, with rocky terrain, and a few rock-hop stream crossings. Although the route is challenging, the views are incredibly rewarding. Sunfish Ponds is a 7.8 mile loop that takes an average of 4 hours and 10 minutes to complete.

The trail is popular for backpacking, camping and hiking since it is a part of the Appalachian trail. Since it is a popular trail, it is well maintained but there are a few difficult hiking spots where the trail becomes steeper. In some spots climbing is necessary.

Hiking New Jersey

New Jersey has many hikes that showcase the state's natural beauty. From hikes following the Appalachian Trail, venturing through mountains, and forests to trails winding around lakes and rivers, New Jersey is an amazing fall hiking destination. Most of the hikes have rocky terrain but are easy enough to navigate. The Sunfish Pond trail has serene views of the crystal blue waters of a glacial lake. Hikers who brave the challenging White Shore and Long Path Loop Trail will never forget the cliff top view of a waterfall. Stony Lake Loop is a nice trail for hikers looking for an easy stroll with beautiful fall views in the forest. All the trails mentioned here offer an unforgettable hiking experience. The hiking trails in New Jersey offer something for every hiker to enjoy this fall. Whether you are a novice or an expert, planning a hiking trip in New Jersey is a way to enjoy the beauty of fall.

Share

Megan Deak September 23 2023 in Nature

More in Nature

A Dropped Menu Got It Started

Rosalie R. Radomskyhttps://www.nytimes.com/2015/05/17/fashion/weddings/a-dropped-menu-got-it-started.html

You have been granted access, use your keyboard to continue reading.Kinnari Shah and Pawan DeedwaniyaKinnari Shah, the daughter of Bina K. Shah and Kirti Shah of Parsippany, N.J., was married Saturday to Pawan Deedwaniya, a son of Anuja Deedwaniya and Sharad C. Deedwaniya of Poughkeepsie, N.Y. Pandit Arvind B. Maheta, a Hindu priest, officiated, with Pandit Deepak A. Kotwal, also a Hindu priest, leading the ceremony at Rockleigh Country Club, an event spa...

You have been granted access, use your keyboard to continue reading.

Kinnari Shah and Pawan Deedwaniya

Kinnari Shah, the daughter of Bina K. Shah and Kirti Shah of Parsippany, N.J., was married Saturday to Pawan Deedwaniya, a son of Anuja Deedwaniya and Sharad C. Deedwaniya of Poughkeepsie, N.Y. Pandit Arvind B. Maheta, a Hindu priest, officiated, with Pandit Deepak A. Kotwal, also a Hindu priest, leading the ceremony at Rockleigh Country Club, an event space in Rockleigh, N.J.

The bride, 30, who will take her husband’s name, is studying for a real estate sales license at the New York Real Estate Institute in New York. Until 2014, she was the director of events at Colicchio & Sons in New York, one of the chef Tom Colicchio’s restaurants. She graduated from the School of Hotel Administration at Cornell and received a Grand Diplôme from the French Culinary Institute of America in New York.

Mr. Deedwaniya, 28, is a senior securities trader in New York at Jane Street Capital. He graduated with a degree in computer science and finance from M.I.T.

The couple met in February 2013, when Ms. Shah’s best friend from college, Hillary Widlitz, persuaded her and her roommate to venture out to Lillie’s, a Victorian-style bar in Union Square (where the couple is pictured above), during a snowstorm.

“I did not want to go out,” said Ms. Shah, who had left work early that day. “The weather was so bad. I just wanted to have a bottle of wine, order in sushi and just stay in.”

Sign up for the Love & Weddings newsletter. Stories about all things love: the vows couples make, their celebrations and wedding industry news.

Eventually she relented and threw on a white T-shirt and pair of jeans, a far cry from her usual standards for a night out.

At the bar, while Ms. Shah was absorbed in a tête-à-tête with her roommate, Ms. Widlitz swung into matchmaking mode upon seeing Mr. Deedwaniya.

“Hillary is like a Jewish bubbe,” Ms. Shah said. “She looks at me and said: ‘Oh, my gosh. This really cute Indian guy walked into the bar, and he has green eyes.’ I’m not really looking. More than anything, I’m in a serious conversation.”

Undaunted, Ms. Widlitz then dramatically knocked a menu off the table with her elbow.

“My mouth dropped,” Ms. Shah said. “I cannot believe she did this. She taps him on the shoulder, and says: ‘I dropped my menu. Could you please pick it up?’ ”

Mr. Deedwaniya, who was there with a young woman and a young man, recalled thinking the ploy seemed a little fishy, but he played along.

“He was very, very good-looking,’’ Ms. Shah said. “But he was with another girl.”

A few minutes later, Mr. Deedwaniya’s threesome was at the table next to theirs, and after the conversations merged, Ms. Shah learned that the other woman was Mr. Deedwaniya’s cousin and the other man was her boyfriend, who lived above the bar and invited them to join him and his roommates, as well as 15 of their friends who were already upstairs.

After a couple of hours, when Ms. Shah and her friends were ready to leave, Mr. Deedwaniya offered to drive them home in an attempt to talk to Ms. Shah some more. First they cleaned the snow off the car. (Ms. Widlitz, who lived nearby, made her own way home.)

He asked Ms. Shah for her phone number before she followed her roommate out of the car. “I texted her next day,” he said. “I was straightforward.” And after their first date, on the day before Valentine’s Day, they began hanging out regularly.

“We talked about the serious stuff and not-so-serious stuff,” Ms. Shah said. “With us, from Day 1 we spoke about it all: our goals, our family values. And everything matched up perfectly.”

On a warm spring day in April 2014, he proposed in his apartment with flowers and candles everywhere, and surprised her by inviting their families to celebrate with them at the Carriage House restaurant in the West Village.

And what of Ms. Widlitz? “She’s one of my bridesmaids,” Ms. Shah said, “and now I’m on a mission to find her Mr. Right.”

Klein to retire as CEO at Crestron, a billion-dollar global business based in Rockleigh

ROI-NJ Staffhttps://www.roi-nj.com/2021/07/12/tech/klein-to-retire-as-ceo-at-crestron-a-billion-dollar-global-business-based-in-rockleigh/

In his more than three decades with the company, Randy Klein helped grow Rockleigh-based Crestron Electronics into a billion-dollar business that operates around the globe.Klein, the CEO and president of the company since...

In his more than three decades with the company, Randy Klein helped grow Rockleigh-based Crestron Electronics into a billion-dollar business that operates around the globe.

Klein, the CEO and president of the company since 2013, announced Friday he will retire later this year. Daniel Feldstein, the current chairman and chief operating officer and the son of Crestron founder George Feldstein, will assume the roles of CEO and president.

Crestron, which was founded in Bergen County in 1971, has grown to become a global leader in workplace technologies, engineering and transforming corporate automation and unified communication solutions for enterprise organizations across Fortune 500 corporations. It also has become a premium home automation provider which creates platforms, devices and systems across residential properties, including homes, yachts, multi-family buildings and hotels.

Klein said the decision to retire was bittersweet – and one of the hardest he ever has had to make.

“Later this fall, I will be retiring from this wonderful company that has been my home and second family for more than 30 years,” he said. “As president and CEO, I make a lot of decisions every day. This was one of the most difficult decisions I have ever made.”

Klein said the timing is right.

“Crestron is in a better place than it has ever been,” he said. “We have emerged from the past 16 months stronger than ever, more united and more resolved to take on the future and all the opportunity that it holds.

“I am proud of my achievements, but even more proud of Crestron as a company. There are no words to describe my 30-year journey: our accomplishments, tremendous changes, incredible growth and all the people I’ve met and friendships that I’ve made. Those are the things that can never be replaced, and I will treasure them for a lifetime.”

Crestron designs software and hardware solutions for lecture halls and boardrooms, as well as residential properties around the globe. As technology has become omnipresent in both work and home lives, Crestron feels it is charting the future of digital transformation for commercial and residential applications by identifying and manufacturing solutions that strengthen collaboration, productivity and innovation.

Sidney Altman, Nobel laureate in chemistry, dies at 82

Matt Schudelhttps://www.washingtonpost.com/obituaries/2022/04/08/nobel-prize-sidney-altman-dies/

Sidney Altman, a Canadian-born researcher who shared the Nobel Prize in chemistry for a discovery about the cellular function of RNA, which changed scientists’ fundamental understanding of biochemical processes and has had applications to medicine and gene therapy, died April 5 in Rockleigh, N.J. He was 82.Yale University, where Dr. Altman was a professor for many years, announced his death in a statement, saying he had a long, unspecified illness.Dr. Altman trained as a physicist before developing an interest in biologic...

Sidney Altman, a Canadian-born researcher who shared the Nobel Prize in chemistry for a discovery about the cellular function of RNA, which changed scientists’ fundamental understanding of biochemical processes and has had applications to medicine and gene therapy, died April 5 in Rockleigh, N.J. He was 82.

Yale University, where Dr. Altman was a professor for many years, announced his death in a statement, saying he had a long, unspecified illness.

Dr. Altman trained as a physicist before developing an interest in biological sciences and chemistry. He made his key discovery in 1978 when he showed that ribonucleic acid (RNA) — one of the basic molecules present in every living cell — possessed previously unknown properties.

Before Dr. Altman published his study, scientists believed that enzymes — molecules with catalytic properties that promoted chemical reactions — were proteins. The purpose of RNA, it was thought, was to transmit genetic information contained in DNA to the proteins.

Conducting his research on E. coli bacteria, Dr. Altman showed that RNA did more than simply transfer genetic material within the cells: It could also undergo a transformation that would allow it to perform the functions of an enzyme, engaging in chemical reactions.

At first, few people believed Dr. Altman. But in 1980, Thomas R. Cech, a scientist at the University of Colorado, verified Dr. Altman’s findings in separate and independent experiments. Dr. Altman and Cech were awarded the Nobel Prize for chemistry in 1989.

Their research upset the conventional understanding of cellular biology and of how genetic information is transmitted. Dr. Altman and Cech proved conclusively that nucleic acids are the building blocks of life.

The Nobel Academy described their findings as “the two most important and outstanding discoveries in the biological sciences in the past 40 years,” second only to the description of the double-helix structure of DNA in the 1950s by Francis Crick and James D. Watson.

As it happened, Crick played a significant role in Dr. Altman’s development as a scientist. Struggling to find his footing in physics, Dr. Altman was inspired to study biological sciences at least in part by a scientific paper he read in the 1960s.

“It was a paper on the nature of the genetic code,” Dr. Altman said in a 2000 interview for the Nobel Prize website. “It said that the genetic code is read in groups of three letters from DNA, essentially. And it was a paper from Cambridge, England, and Francis Crick and Sydney Brenner were the senior authors. And I remember thinking to myself, not merely this is again very elegant, beautiful, but thinking to myself, how could they possibly have understood this? How did they find this out?”

Crick had won the Nobel Prize in 1962 for his DNA discovery with Watson, and Brenner later won the Nobel in 2002 for work in genetics. The scientists had a laboratory in Cambridge, where Dr. Altman worked from 1969 to 1971 in a setting he called “scientific heaven.”

It was in Cambridge that Dr. Altman began his work on the genes of transfer RNA (tRNA), a component of RNA. After joining the faculty at Yale in 1972, Dr. Altman continued his work and ultimately, with the help of graduate students, made his major breakthrough.

Sidney Altman was born May 8, 1939, in Montreal. Both of his parents were Jewish immigrants from Eastern Europe. His mother had worked in a textile mill, and his father had a grocery store.

Dr. Altman attended English-language schools and also became fluent in French in Montreal. He had wide-ranging interests, including literature and sports, but was especially fascinated by science. He was curious about how atomic bombs were built — he was 6 when World War II ended — and later read a book about the periodic table of elements.

“For the first time I saw the elegance of scientific theory and its predictive power,” he wrote in a biographical essay for the Nobel website. “I should mention that while I was growing up, [Albert] Einstein was presented as a worthy role model for a young boy who was good at his studies.”

He planned to attend college in Canada until a friend persuaded him to apply to the Massachusetts Institute of Technology. He was admitted, but his friend was not. After receiving a bachelor’s degree in physics in 1960, he spent two years as a graduate assistant at Columbia University.

After taking a summer course in molecular biology, Dr. Altman continued his studies at the University of Colorado, receiving a doctorate in biophysics in 1967. He spent two years as a researcher at Harvard University before his two years in England with Crick and Brenner.

In addition to his scientific research, Dr. Altman became a department chairman in molecular, cellular and developmental biology at Yale. From 1985 to 1989, he served as dean of Yale College, the university’s undergraduate college. He was named to the position by Yale’s president at the time, A. Bartlett Giamatti, a close friend.

Dr. Altman, who was widely read in many fields, helped shape Yale’s undergraduate curriculum, expanding course offerings in science and languages.

“As someone who was himself a great reader and a beautiful writer, and widely knowledgeable,” Yale President Peter Salovey said in a statement, “he believed non-scientists should have an understanding of science, and that scientists would benefit by having a richer understanding of the humanities, arts, and social sciences.”

Dr. Altman also had a strong interest in Jewish cultural matters and helped found a Judaic studies program at Yale. He became a U.S. citizen in the 1980s while retaining his Canadian citizenship.

His marriage to Ann Korner ended in divorce. Survivors include two children and four grandchildren.

Long after receiving his Nobel Prize, Dr. Altman continued to do research based on his earlier RNA studies, including efforts to find gene-based treatments for malaria and other diseases.

Asked to give advice to students by a Nobel website interviewer, Dr. Altman emphasized the importance of believing in oneself and a willingness to work hard.

“It could be a letter carrier, it could be a sales manager in a store or a university professor,” he said. “All the people who do well work very hard. Nobody who has a record of achievement has been lazy about it.”

Disclaimer:

201-292-0706

201-292-0706